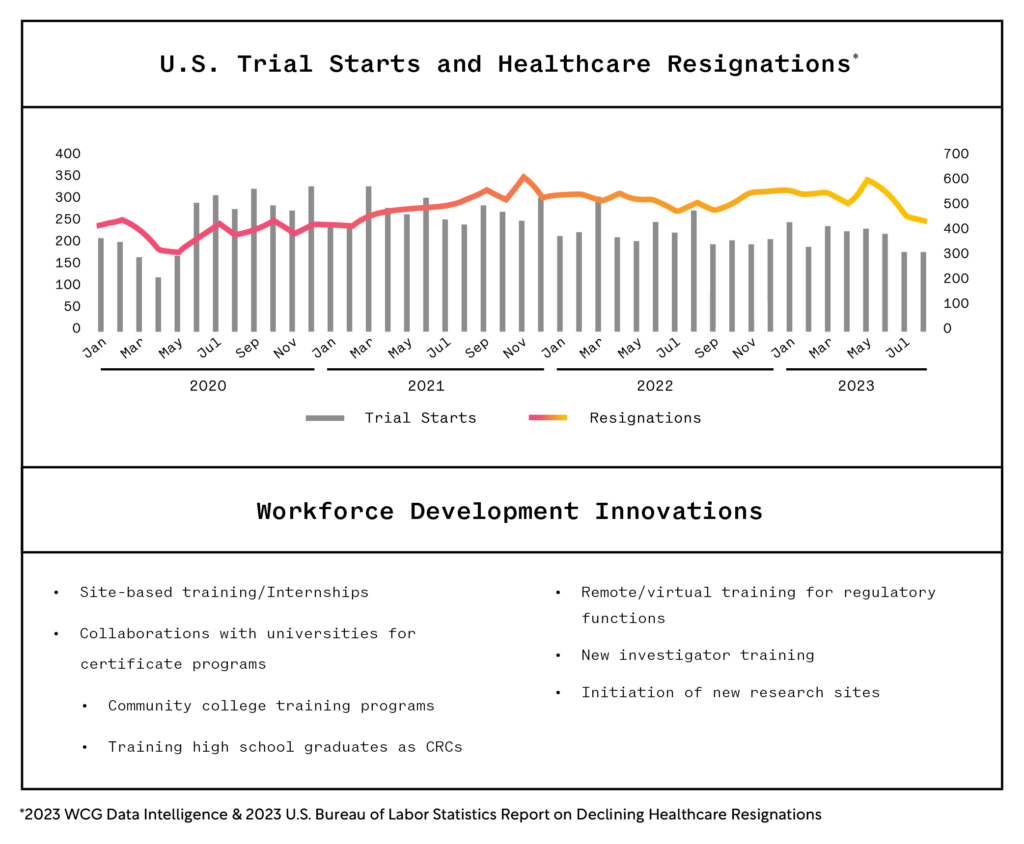

The tumultuousness of the ‘pandemic years’ has lessened, giving rise in 2024 to an intense focus on people, timelines, and quality in conducting clinical research. Near the end of 2023, research sites reported more stabilization in the research workforce, consistent with the U.S. Bureau of Labor Statistics report of declining resignations in healthcare (see graphic). Since 2020, the most critical concern at research sites has been workforce retention and recruitment. The availability of qualified research professionals will remain a top concern in 2024. Innovations in workforce development will continue to expand through research sites, professional organizations, and partnerships as the industry highlights the role of the clinical research professional as an intentional career choice.

Aside from workforce issues, clinical trials sites continue to face numerous headwinds ranging from capacity limitations to increasingly complex protocol designs and the inability to meet trial enrollment targets and timelines. These factors contribute to the increasing trend in clinical trial completion taking an average of ten months longer to complete in 2023 vs. 2020.2

While the impact of The Great Resignation has lessened, clinical research sites and pharmaceutical company partners are mutually invested in accelerating clinical trial activation. Focusing on oncology, a therapeutic area representing over 40% of the sponsored trials opened in 2023,3 guidance from the National Cancer Institute (NCI) suggests a target activation timeline of 90 days. Some sites report meeting or exceeding this target, but far more are establishing action plans to reduce their activation times currently surpassing 100, 200 or even 300 days.

Across all therapeutic areas, there is disparity in median time for trial activation, defined as time from site selection to completion of contract. For the past 3 years for Phase I-III trials, the median timeframe for Academic Medical Centers (AMCs) and hospitals is 8.12 months vs. independent sites/physician practices with a median of 4.37 months.4 With many steps and variables in the start-up process, one task consuming weeks to months is the negotiation process for both budgets and contracts. Budget negotiation timelines trended an average of eight days longer in 2023,5 likely impacted by higher site costs due to inflation. Concentrated efforts on improving activation timelines through workflow optimization will include use of centralized ethical and biosafety review, deployment and linking enabling technologies, evaluating options for outsourcing administrative services, and enhanced communication in negotiations.

References

1. US Bureau of Labor Statistics, 2023 & WCG Data Intelligence, 2023

2-5. WCG Data Intelligence, 2023