The site selection and feasibility process shouldn’t be hard. It’s really quite straightforward on paper. And yet, it is astonishingly hard. We all know the dismal numbers; here are just a few to highlight:

- 11% of sites selected never enroll a single patient

- Sponsors’ original timelines end up doubling in order to meet the desired goals (and nearly 80% of clinical trials fail to meet their timelines)

- Operational costs of running a trial are an estimated US $37k/day

What these numbers tell me – and should tell all of us – is that we’re simply not doing enough to get the right sites involved in the right trial.

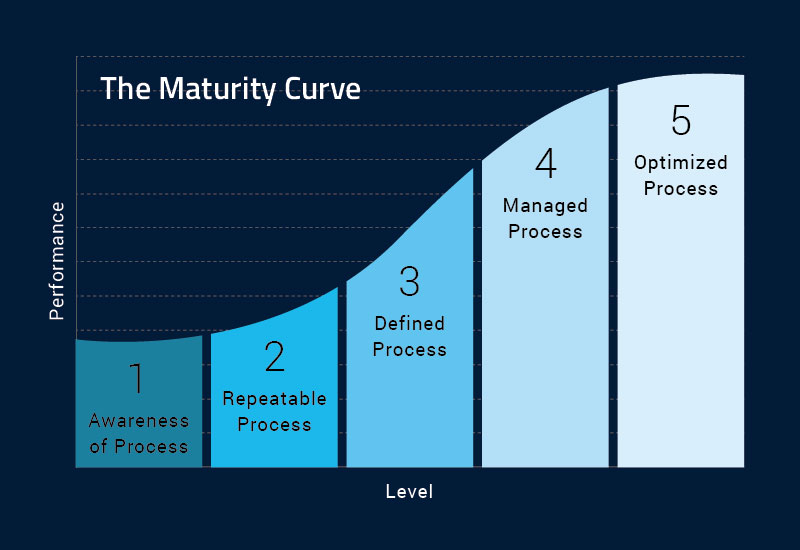

But perhaps we all know that. Here’s the question: Why does the study start-up process fail us so often? That question must be answered if those stats are ever going to change. I believe a maturity model is the way to answer the question.

A maturity model for feasibility

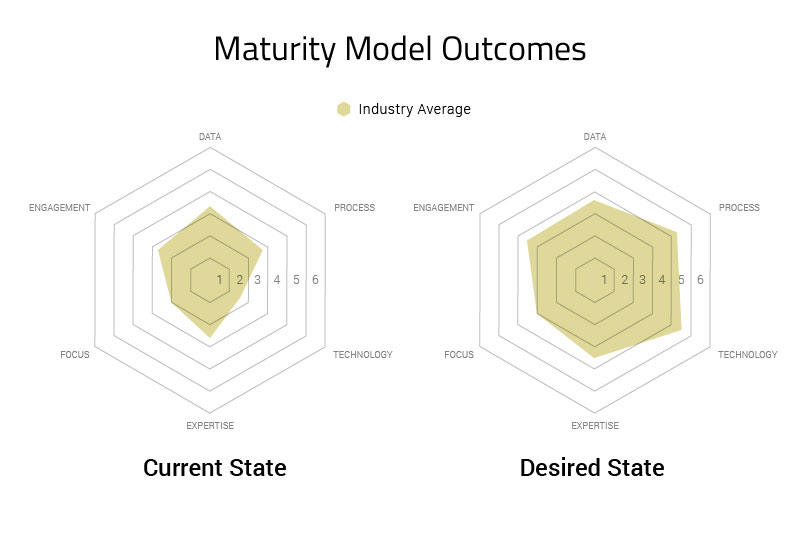

Everyone understands how a maturity model works. Going through a maturity model, you typically rate a series of variables to describe your current and aspirational states. Based on those scores, you’ll see where you have areas for improvement. You’re likely already familiar with McKinsey’s 7-S Strategy Model, used to evaluate organizational effectiveness and alignment, or perhaps the Capability Maturity Model, created to measure the maturity of software development practices.

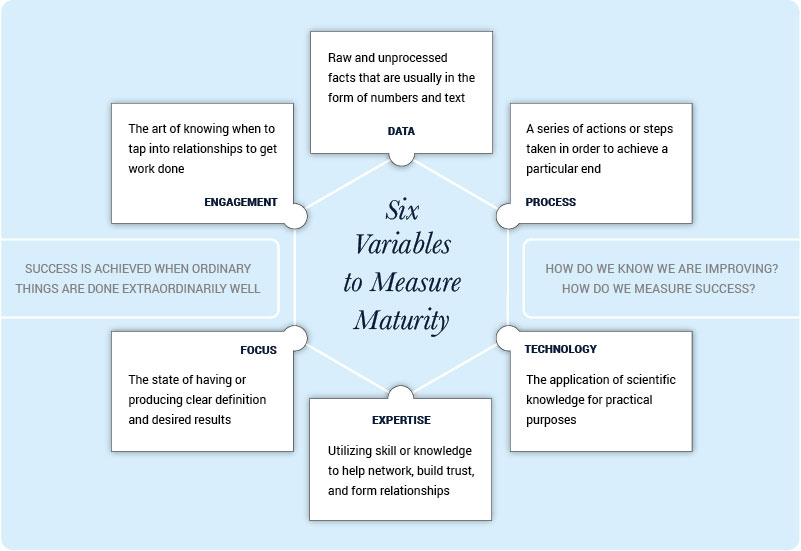

These maturity models have been developed and honed over time. And over this time, they’ve all worked for their specific purposes, but it’s past time to measure maturity vis-à-vis feasibility and site selection. So much like the McKinsey models, we’ve identified six variables to measure maturity. Each is important by itself, but together, they are powerful: data, process, technology, expertise, focus, and engagement.

The Six Variables to Measure Maturity in Site Feasibility

1. Data: to illuminate insights

The industry has no shortage of data. That is, quite literally, what our industry is about. But, we don’t take full advantage of its power or even use it correctly, in many cases. Folklorist Andrew Lang captured the perils of this quite well: “He uses statistics as a drunken man uses lampposts—for support rather than illumination.” Many businesses, even in our data-driven industry, use data to support their decisions instead of drive their actions.

But data is really only valuable if you can translate it into actionable insights. And to do that, you must understand it.

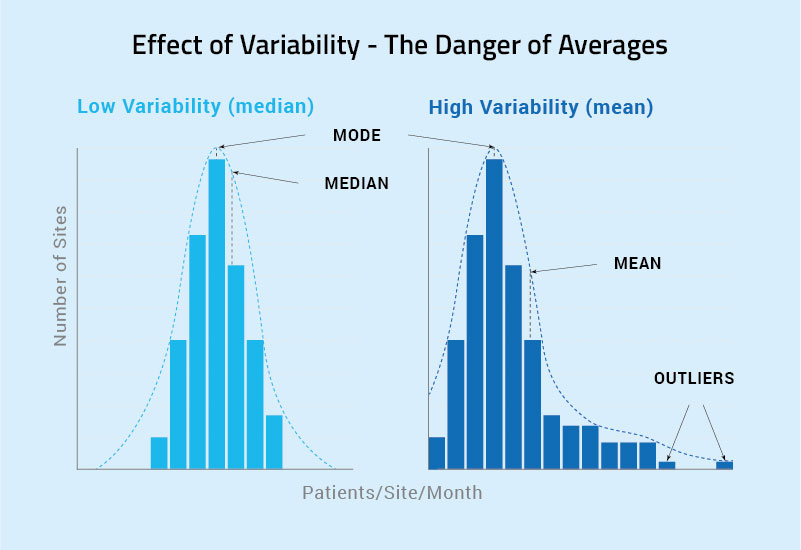

For example, I often see individuals using the average when they should be using the mean. As you can see from the chart, the difference is significant, and that one mistake can set you off in the wrong direction.

2. Process: an account-management feasibility approach

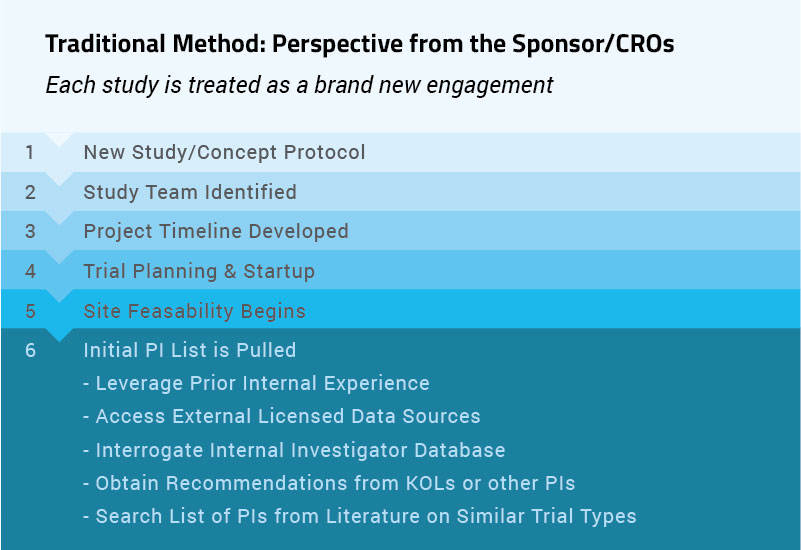

We can all agree the current start-up process sponsors and CROs follow is flawed. Across these parties, the process typically looks the same.

Each study is treated as an entirely new engagement, which creates unnecessary work. Sites are frustrated: they can’t get access to new customers, they don’t know what the feasibility scorecard is, and they have questions no one will answer.

Here’s just a small sample of what we hear from sites:

- “I keep doing studies for a handful of sponsors, I need to expand my reach. How do I get on other Sponsors’ lists?”

- “Every time I engage with a new study, even for an existing sponsor, it’s like I’m working with a new team – the rules and processes keep changing.”

- “Last month, I updated my FDA 1572 with new contact information and associated regulatory documents – don’t you have that?”

Let me propose an alternative: an account-management approach to site identification. I’ve broken it down into four categories:

- Design a library of questionnaire templates and a list of investigators

- Build deep site relationships and treat them like customers

- Convert quickly and effectively

- Activate sooner

3. Technology for speed and automation

We’re entering the second decade of the 21st century. Site feasibility cannot be a manual or analog process. It demands sophisticated technology and, just as important, the right technology.

As with data, the industry has plenty of technology. What we need is technology that allows study teams to find and qualify the best set of investigators for a given trial. This boils down to the speed and automation of feasibility. I’ve broken it down into three areas:

- Increased visibility and transparency throughout the process, including ease of tracking responders and non-responders

- Automation: follow-up thresholds and ranking of sites based on scoring algorithms

- Simple and easy: pre-population of responses based on previously submitted surveys

4. Expertise: An art and a science

There’s a tremendous amount of data and information that is getting funneled to our teams to help them with site identification, but who makes sense of it all? Expertise is the art of taking data from disparate sources and turning it into insights, and the science of using that expertise in developing better outcomes more quickly, efficiently, and effectively.

When manually conducting site feasibility, there’s no transparency to the various stakeholders throughout the organization as to how the sites have actually responded.

In many cases, there are times when a site will provide an estimated number of patients they could contribute, but by the time the decisions are made as to whether that site should participate in the study or not, the numbers are pretty far off from the original timeline. In this example, you could ascertain that if the sites received an email with no prior notification from the study field team, they will either ignore it or the communication will go to their junk mail, or perhaps even deleted.

However, what if the study field teams let the sites know the feasibility questionnaire was coming, and the sponsor was interested in their participation in the upcoming study? By using this strategy, we’ve seen a higher likelihood of response – in some cases a 73% increase in response.

So, yes, you need the right technology (science) in place, but it’s only one piece of the equation. You need the experts, the process, and the buy in of all parties to execute properly.

5. Focus

During site selection and feasibility, there are at least a thousand tasks and activities that must be done concurrently. Success demands intense focus on everything from picking the best set of investigators to getting them to convert to your study as quickly as possible. Even looking at the highest-level questions drives this point home.

Feasibility cannot be just another item to check off a task list, and it most certainly cannot be left to chance.

6. Engagement: Building and Sustaining Relationships

If I had to choose one of these six variables as the most important, it would be this. It’s all about relationship building. The one-off transactional approach to feasibility no longer works—if it ever did.

When we talk about engagement and relationships, we’re talking about networking and building trust. Networking allows you to share knowledge and ideas, provide opportunities and connections. Trust, of course, is an incredibly valuable business commodity and a reputational asset.

Engagement and relationships creates results.

When you take the time to build genuine relationships with your sites, you get to know what they truly want and need from you. You gain knowledge and context, not just information. From there, it becomes possible to set goals and define expectations going forward. That can be something as simple as a pre-call to the sites that you’re interested in and giving them a heads-up on your study rather than shooting off an email. I find a huge difference when we’re actually physically calling the potential investigators and talking to them about the really exciting portion of that study.

We know this because it’s how we do business. Building strong relationships with sites is what allows us to deliver the best results for them and their business outcomes.

Plotting the Future

Once you assess those variables, you plot your current and desired states. If you compare them to industry averages, you get something like the chart at right.

And that’s the roadmap to success. If this approach is utilized correctly, there are several expected, promising results:

- Quick identification of high-performing investigators built intelligently via data and relationships.

- Rapid responses to site feasibility questionnaires due to shortened surveys, leveraging relationships, and better planning.

- Optimized processes that Sponsors and CROs can deploy across all studies in their portfolio, not just one-by-one.

It’s Time

Sponsors are frustrated with their current lengthy and inefficient study start-up processes and want a proven partner—a partner who can help them reduce study timelines by 30% or more by getting them to full enrollment three times quicker.

I’ve been in this industry for 25-plus years, and I’ve seen how stuck some sponsors and CROs have become. I developed the Feasibility Maturity Model because I have a real passion for trying to make site identification process much easier, more effective for everyone involved.

Benchmark site performance for your study

Interested to see how the investigators in your current or planned studies match up against the historic performance of all available investigators for the therapeutic area of the study?

Complete the form to schedule a consultation with WCG. We’ll share benchmark data, analyze your results, and share some of the common practices of top performers.